VA home loans have impressive rates and terms, making them some of the most desirable mortgage loans to apply for. Curious as to what it takes to get a veteran home loan? Here’s everything you need to know to get started.

How To Know if You Qualify for A Veteran Home Loan

You’ll need a document that confirms that you meet VA home loan requirements. This document is called a VA Certificate of Eligibility (COE). It’s an official document that proves that you are an active-duty military member, a veteran, a National Guard or Reserve member, or a surviving spouse of someone who served in the military in that capacity.

While you’re able to apply for a VA loan without a certificate of eligibility, you’ll need to provide it before the home loan can close.

Fortunately, getting one from the Department of Veteran Affairs is easy.

How to Request a Certificate of Eligibility

- Ask your VA-approved lender to get it for you.

- Request the certificate online through the VA’s eBenefits portal.

- Complete a Certificate of Eligibility form and mail it to a regional loan center.

The fastest way to obtain the certificate is through a VA-approved lender as they have access to an internet-based application that can issue the certificate “on the spot.”

You can also download the “determination of loan guarantee eligibility” form and take it to the lender for processing.

What You’ll Need to Request Your VA COE

Usually, the only info lenders need to get the certificate through the VA database is standard personal info. But some instances will require additional documentation. In that case, the lender will send the necessary documents directly to the VA to process.

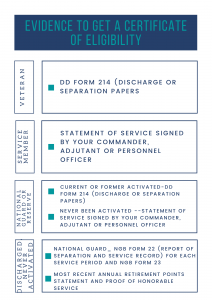

The type of docs you need to provide for a certificate of eligibility depends on whether you’re a veteran, service member, active or discharged National Guard or Reserve member. According to the VA website, here’s what you’ll need:

For the most up-to-date information on eligibility for veteran home loans, please contact us or visit the official VA website.